We present here the history of Aioi Nissay Dowa Insurance.

In 2010, Aioi Insurance, Nissay Dowa General Insurance and the Mitsui Sumitomo Insurance Group* came together to form the MS&AD Insurance Group. In the same year, Aioi Insurance and Nissay Dowa General Insurance merged to become Aioi Nissay Dowa Insurance.

| 1897 | Forerunners of Aioi Nissay Dowa Insurance, Otaru Cargo Fire Insurance and Yokohama Fire & Marine Insurance, established during the boom years following Japan's receipt of indemnities to end the First Sino-Japanese War |

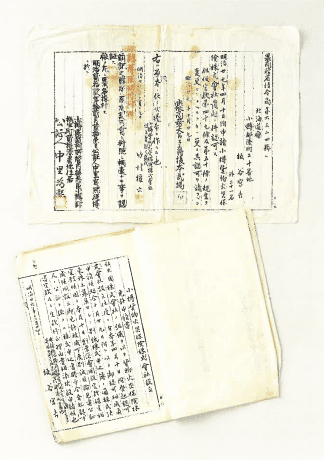

Certified registration certificate of establishment and application for business license for Otaru Cargo Fire Insurance  Headquarters of Yokohama Fire & Marine Insurance |

|---|---|---|

| 1918 | Tokyo Movable Property Fire Insurance, forerunner of Aioi Nissay Dowa Insurance, began operations during the boom years following the end of the World War I |

Tokyo Movable Property Fire Insurance agency sign |

| 1944 | During the era of wartime financial controls, Dai-Tokyo Fire Insurance and Dowa Fire & Marine Insurance were established through mergers by order of the Ministry of Finance |

Dai-Tokyo Fire Insurance Nihonbashi Building, completed in June 1931 |

| 1945 | Okura Chiyoda Fire & Marine Insurance established (renamed Chiyoda Fire & Marine Insurance in the following year) |

Company emblem for Okura Chiyoda Fire & Marine |

| 1983 | Launch industry's first 24-hour, 365-day claim hotline service | |

| 1989 | Dai-Tokyo Fire & Marine Insurance Shinjuku Headquarters Building completed |

Dai-Tokyo Fire & Marine Insurance Shinjuku Headquarters Building |

| 1995 | Dowa Fire & Marine Insurance Headquarters Building (Phoenix Tower) completed |

Dowa Fire & Marine Insurance Headquarters Building (Phoenix Tower) |

| 1996 | Chiyoda Fire & Marine Insurance Ebisu Headquarters Building completed |

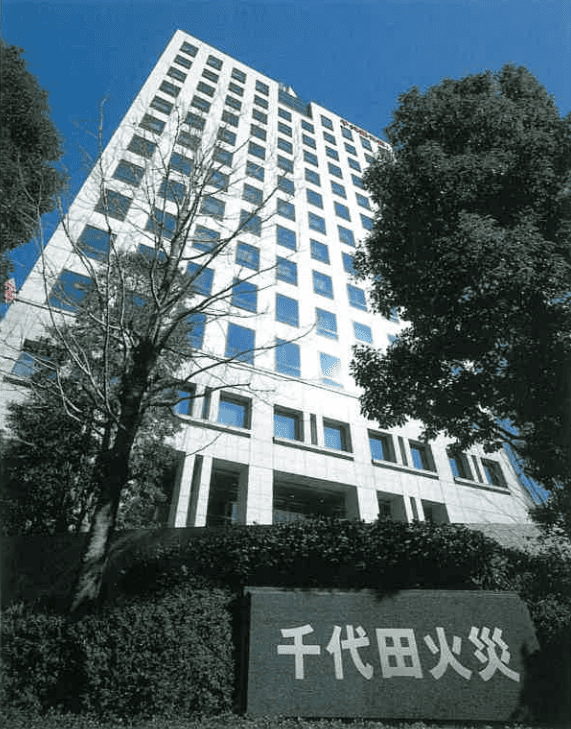

Chiyoda Fire & Marine Insurance Building |

| Dai-Tokyo Shiawase Life Insurance, Chiyoda Kasai Ebisu Life Insurance and Dowa Life Insurance established | ||

| 2001 |

Aioi Insurance established through merger of Dai-Tokyo Fire Insurance and Chiyoda Fire & Marine Insurance Aioi Life Insurance established through merger of Dai-Tokyo Anshin Life Insurance and Chiyoda Kasai Ebisu Life Insurance Nissay Dowa General Insurance created through merger of Dowa Fire & Marine Insurance and Nissay General Insurance |

Logo for Aioi Insurance |

| 2002 | First insurance company to develop mobile phone service to allow policyholders to confirm status of accident processing | |

| 2004 | Secured approval of UK Financial Services Authority to establish Aioi Motor & General Insurance Company of Europe | |

| Launch Japan's first Pay-As-You-Drive (PAYD) Vehicle insurance |

|

|

| 2010 | Agree to engage in discussions of management integration and business alliance with the Mitsui Sumitomo Insurance Group | |

| MS&AD Insurance Group launched on back of the combination of 3 companies: Aioi Insurance, Nissay Dowa General Insurance and Mitsui Sumitomo Insurance |

|

|

| Aioi Insurance and Nissay Dowa General Insurance merged to create Aioi Nissay Dowa Insurance |

|

|

| 2011 | Mitsui Sumitomo Kirameki Life Insurance and Aioi Life Insurance merged to create Mitsui Sumitomo Aioi Life Insurance | |

| Launch au Insurance as a joint venture with KDDI | ||

| Eco Mark Certification received for Vehicle insurance series TOUGH | ||

| Aioi Nissay Dowa Insurance merged with Adlick Insurance | ||

| 2012 | Launch combined ELP and D&O insurance plan | |

| 2015 | Acquire Box Innovation Group (BIG), including subsidiary Insure The Box Limited which provides telematics motor insurance in the UK | |

| Launch TOUGH Connecting Vehicle Insurance which combines leading-edge telematics technology and advanced, efficient Vehicle insurance | ||

| 2016 | Receive approval for first ever PAYD Vehicle insurance in Thailand | |

| Establish Toyota Insurance Management Solutions USA, LLC (TIMS) as a joint venture between Aioi Nissay Dowa Insurance, Toyota Financial Services and Toyota Motor | ||

| Provide telematics Vehicle insurance in the US through Toyota Insurance Management Solutions (TIMS) | ||

| Enter into a joint development agreement with University of Gunma to promote research into the implementation of next-generation mobility | ||

| Develop Sasaeru NAVI, a new product that leverages telematics technology | ||

| 2017 | Enter into a joint agreement with Shiga University to establish Japan's first Data Science Faculty Establish insurance industry's first dedicated Big Data research facility at Shiga University | |

|

Establish Aioi Nissay Dowa Insurance Services Asia Pte. Ltd (AIS Asia) in Singapore, as a base for the telematics business in SE Asia Establish 4 global bases for the telematics business (Europe, US, SE Asia, Japan) |

||

| 2018 | Launch Japan's first telematics Vehicle insurance product based on driver behavior, TOUGH Connecting Vehicle Insurance |

|

| Comprehensive collaborative research agreement signed between Aioi Nissay Dowa Insurance and Kokugakuin University | ||

| Launch TOUGH MIMAMORU Vehicle Protection Insurance, supporting safe driving by providing industry's first alerts for driving the wrong way on expressways and driving outside of designated areas | ||

| 2019 | Release industry's first telematics damage service system, an accident response system that leverages digital data acquired from visual images, location data and accelerometer data | |

| Aioi Nissay Dowa Insurance establishes special joint research program on MaaS with Kagawa University | ||

| Develop TOUGH MIMAMORU Vehicle Protection Insurance Plus (Driving recorder-type) |

|

|

| Develop dedicated cyber insurance for users of emergency response services | ||

| Release I'm ZIDAN Web video for 24/7 claim hotline service: 'No such thing as out of hours for accidents' |

|

|

| Establish Next-generation Mobility Accident and Service Research Center at Gunma University | ||

| 2020 | Launched TOUGH MIMAMORU Vehicle Protection Insurance Plus, a product in which the degree to which the policyholder engages in safe driving behavior based on data acquired from a dedicated dashcam telematics device, is reflected in insurance premiums |

|

| Begin providing a accident response system which leverages telematics technologies starting with products such as TOUGH MIMAMORU Vehicle Protection Insurance Plus, the Telematics Claim Service System | ||

| Jointly develop Pay-How-You-Drive telematics Vehicle insurance product BrightDrive with major US insurance player Nationwide | ||

| 2021 | Launch TOUGH MIMAMORU Vehicle Protection Insurance Plus S, a PHYD telematics insurance product which leverages AD’s proprietary onboard device and a smart phone app | |

| Launch telematics Vehicle insurance product where premiums reflect driving safety in vehicles enabled for autonomous driving. No premiums charged while vehicle is in autonomous driving mode. Greater use of safe and secure autonomous driving mode generates more savings on premiums |

|

|

| Launch Food eco, a product targeted at food service operators to cover recall expenses on food products | ||

| Aioi Nissay Dowa Insurance signs comprehensive collaborative agreement with Institute of Science Tokyo (former Tokyo Medical and Dental University), focusing on the implementation of medical risk management in the VUCA era | ||

| 2022 |

All customers now able to enroll in telematics Vehicle insurance Launch sales of PHYD telematics Vehicle insurance for non-fleet enterprise customers |

|

| Launch Carbon Neutral Support rider for corporate fire insurance policies. Develop new compensation aligned with the realization of a decarbonized society | ||

| Establish Little Family Small Amount Short-term Insurance Co. Ltd. to provide lifetime support for our littlest family members, dogs and cats, with pet insurance products Wan Days/Nyan Days | ||

| Launch Traffic Safety EBPM Support Service by leveraging vehicle driving data. Support regional governments to develop and verify the impact of traffic safety measures | ||

| Aioi Nissay Dowa Insurance and Tokyo University start joint research into reducing CO2 emissions through the use of telematics technology | ||

| 2023 | Aioi Nissay Dowa Insurance receives Prime Minister's Award as Champion of Winter Digi-den Koshien |

|

| Launch new service for the visualization of CO2 emissions reduction impact through telematics Vehicle insurance. Promote safe and environmentally friendly driving to realize carbon neutrality | ||

| World First: Use AI to analyze satellite images to visualize average value of losses on buildings in specific regions as a result of a typhoon in as short as 3 days. Reduce the average time from initial claim to loss adjustment by 7 days, making it possible to arrange for repairs at an earlier stage | ||

| Tokyo University of Agriculture and Aioi Nissay Dowa Insurance sign comprehensive collaboration agreement, initiate joint research to analyze car accident data, with the aim to realizing a safe and secure car-based society | ||

| 2024 | First for Japan: Begin providing dedicated Generative AI insurance to indemnify risks related to generative AI. Eliminate fears related to adoption of AI, contribute to the safe and secure development of generative AI |